Execution settings help guide

Overview

Welcome to the Execution Settings guide for our algorithmic trading platform. This guide will help you understand how to configure execution settings effectively while creating options and futures strategies in the Indian market. The feature is designed to give traders precise control over how their orders are executed, whether for entry or exit, using Market, Limit or Stop-Limit orders.

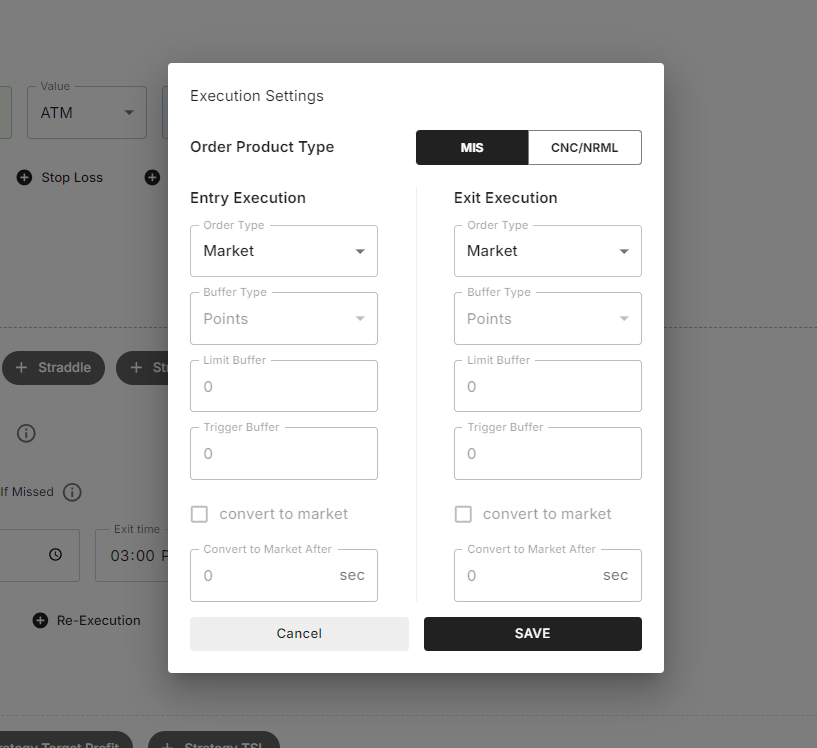

1. Order Product Type

In the Order Product Type section, you can select between two options:

- NRML (Normal Order): Suitable for positional trades where you intend to hold the position beyond intraday.

- MIS (Margin Intraday Square-off): Used for intraday trading where positions are automatically squared off before the market closes.

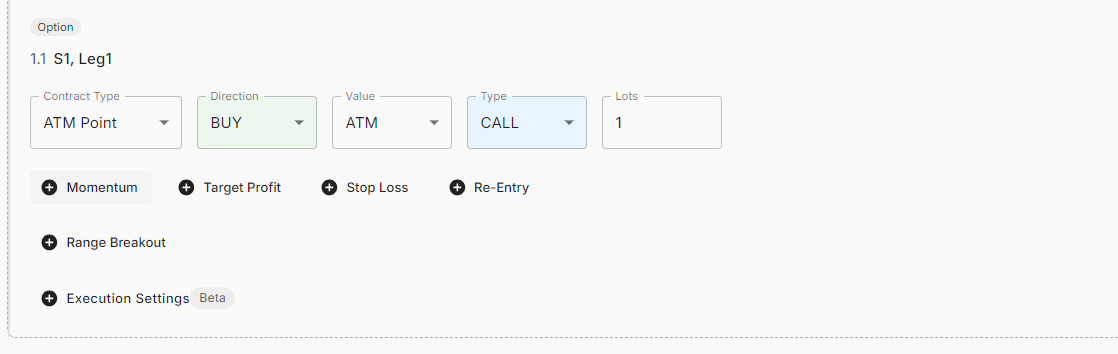

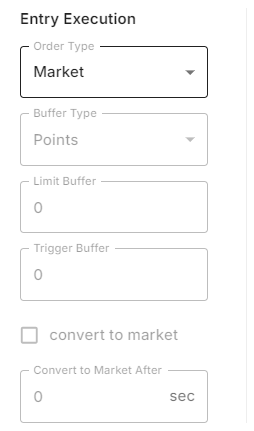

2. Entry Execution Settings

The Entry Execution settings determine how your bot places entry orders when entering a position. This section allows you to set the following parameters:

- Order Type: Choose between Market and Limit orders. The default is Market.

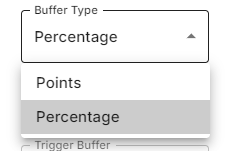

- Buffer Type: Select between Points or Percentage. This option is enabled only when Limit is selected as the Order Type.

- Limit Buffer: Set the buffer in points or percentage to adjust the limit price. This is useful when you want to buy slightly above or below the current price.

- Trigger Buffer: Define a trigger price buffer for stop-limit orders. This is used to ensure that the order is executed only when the price reaches a specific level.

-

Convert to Market After: Specify the time in seconds after which a pending limit or stop-loss order should be converted to a market order if not filled.

Examples: -

Simple Limit Order Example:

- Scenario: You want to enter a long position in NIFTYBANK when the price reaches ₹42,000.

- Configuration: Set the Order Type to Limit, Buffer Type to Points, and Limit Buffer to 10.

-

Result: A limit buy order will be placed at ₹42,010 (₹42,000 + 10 points).

-

Stop-Limit Order Example:

- Scenario: You want to enter a long position in NIFTYBANK 14AUG2452100CE when it hits ₹200, but only if the price stays above ₹195.

- Configuration: Set the Order Type to Limit, Buffer Type to Points, Limit Buffer to 5 and Trigger Buffer to 5.

- Result: A stop-limit order is placed with a trigger price of ₹195 and a limit price of ₹205. The order will execute if the price reaches ₹195 and then buy at ₹205 or better.

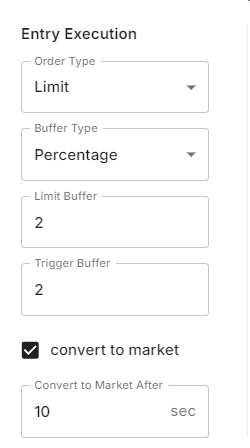

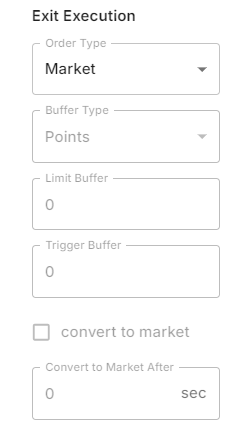

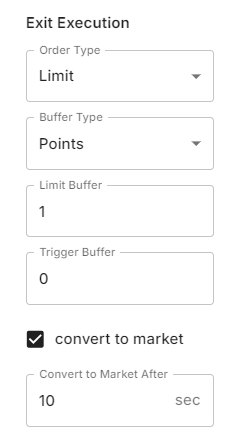

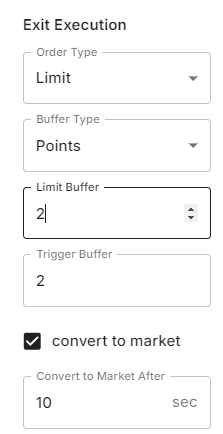

3. Exit Execution Settings

Exit Execution settings control how the bot exits a position. The options mirror those in the Entry Execution, with a focus on managing the exit more effectively:

- Order Type: Market or Limit. The default is Market.

- Buffer Type: Points or Percentage, enabled only for Limit orders.

- Limit Buffer: Adjusts the limit price for the exit order.

- Trigger Buffer: Sets a buffer for the trigger price in stop-limit orders.

-

Convert to Market After: Specifies a time after which an unfilled limit order is converted to a market order.

Examples: -

Simple Exit with Limit Order:

- Scenario: You want to exit a long position in NIFTYBANK 14AUG2452100CE at ₹500.

- Configuration: Set the Order Type to Limit, Buffer Type to Points, and Limit Buffer to 10.

-

Result: A limit sell order is placed at with ₹490 as limit price (₹500 - 10 points).

-

Advanced Stop-Loss with Trigger Buffer:

- Scenario: You want to protect your long position in NIFTYBANK 14AUG2452100CE with a stop-loss at ₹180, but you want the order to trigger only if the price drops below ₹185.

- Configuration: Set the Order Type to Limit, Buffer Type to Points, Limit Buffer to 5, and Trigger Buffer to 5.

- Result: A stop-limit order is placed with a trigger price of ₹185 and a limit price of ₹175. The order will execute if the price hits ₹185 and sell at ₹175 or better.

4. Advanced Stop-Loss Orders

Advanced Stop-Loss orders allow for greater flexibility and precision in managing your risk. When configured, an advanced stop-loss order is placed immediately after your entry is confirmed. This order type is ideal for protecting your position in volatile markets.

When is Advanced Stop-Loss Triggered?

- Scenario: Let’s assume you enter a long position in NIFTYBANK at ₹1,000, with a stop-loss set at 20% below your entry price.

- Configuration: You set a Limit Buffer of 2% and a Trigger Buffer of 2%.

- Result: An SL-L (Stop-Limit) order is placed with a trigger price of ₹1,160 (2% below ₹1,000) and a limit price of ₹1,920. If the price drops to ₹1,160, the stop-loss will be activated, and the limit sell order will execute at ₹1,920.

The system will monitor the position continuously. If the market price skips the stop-limit order, the Convert to Market After setting will ensure that the remaining position is closed at the best possible market price after the defined time.

5. Using Buffer Types Effectively

- Points: Best used in highly liquid instruments where price movements are small but frequent.

- Percentage: Ideal for options or futures where price volatility can be significant.

Example: If you enter a long position in NIFTYBANK 14AUG2452100CE at ₹100 and use a 2% limit buffer, the limit order will be placed at ₹102.

6. Conclusion

The Execution Settings feature in our platform is designed to provide traders with the tools they need to execute their strategies with precision. Whether you are entering or exiting positions, these settings allow you to customize the order execution process to match your trading style.

This guide should help you configure these settings with confidence, allowing you to focus on what matters most—your trading strategy. If you have any further questions, feel free to reach out to our support team.