Options Strategy Builder Toolkit

Options algorithmic trading is Automated and Systematic way for traders to automate their process of buying and selling options contracts. Algorithmic trading relies on computer programs to identify and execute trades based on pre-defined rules and conditions.

One of the key advantages of options algo trading is the ability to execute trades quickly and efficiently, without the emotional biases that can affect human decision-making. This can help traders to capitalize on market opportunities and reduce the risk of making costly errors.

SpeedBot's options strategy builder is a tool for options traders to create and analyze various options trading strategies. It allows trader to input different parameters and variables to create and analyze a variety of options trading strategies.

The options strategy builder includes a range of parameters that traders can adjust, such as the underlying asset, the expiration date, the strike price, and the option type (call or put). Traders can also set parameters such as the target profit and the maximum allowable loss.

Once the trader inputs the desired parameters, the strategy builder will generate a variety of potential options strategies, such as straddles, strangles, iron condors, and butterflies. The strategy builder may also provide information on the risk-reward profile of each strategy, including the maximum potential profit, maximum potential loss, and break-even points.

The options strategy builder can be a valuable tool for options traders as it can help them to quickly analyze and compare various options strategies and choose the one that best fits their trading objectives and risk tolerance. Traders can use the strategy builder to test different scenarios and adjust their strategies accordingly, helping to minimize risk and maximize returns.

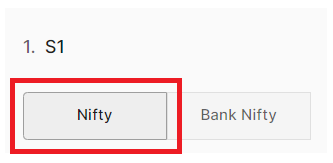

Underlying Instrument

The underlying instrument plays a crucial role in options trading, as its price movement affects the value of the option. Traders must carefully analyze market conditions and the behavior of the underlying instrument in order to make informed decisions about buying and selling options.

For Options Trading SpeedBot supports Nifty, BankNifty and FinNifty as underlying Instruments to create Options Strategy.

The strike price of the options contracts is chosen on the basis of the underlying instrument.

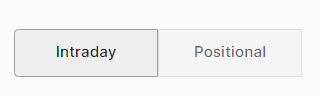

Trading Timeframe

Trading time frame refers to the length of time that a trader holds a position in a financial market.

Day trading / Intraday: This involves holding positions for the duration of the trading day, with all positions closed by the end of the day. Day traders aim to take advantage of intra-day market movements and make profits from short-term price fluctuations.

Position trading: This involves holding positions for several weeks to months, or even years. Position traders aim to capture long-term trends in the market and make profits from major market moves.

On SpeedBot Options Trading Bot Builder, Strategy Creators can create options trading bots on Intraday as well as Positional Basis.

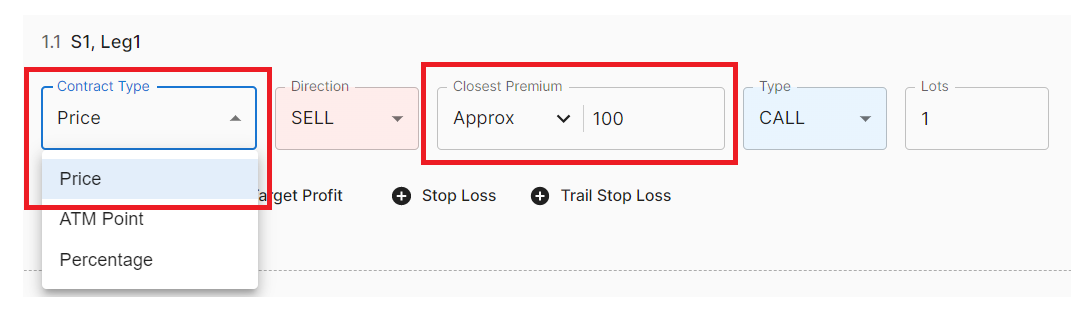

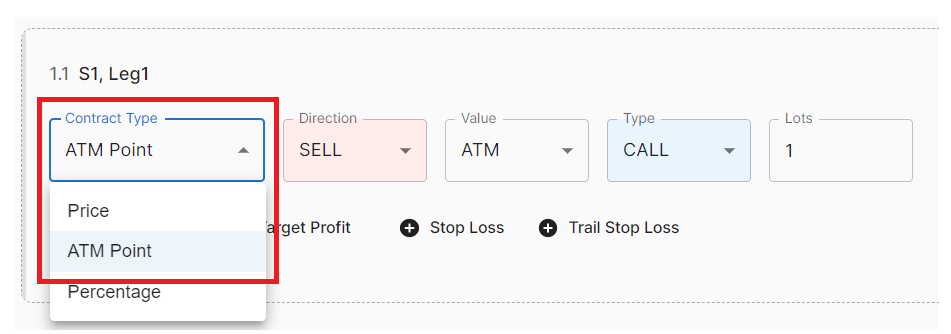

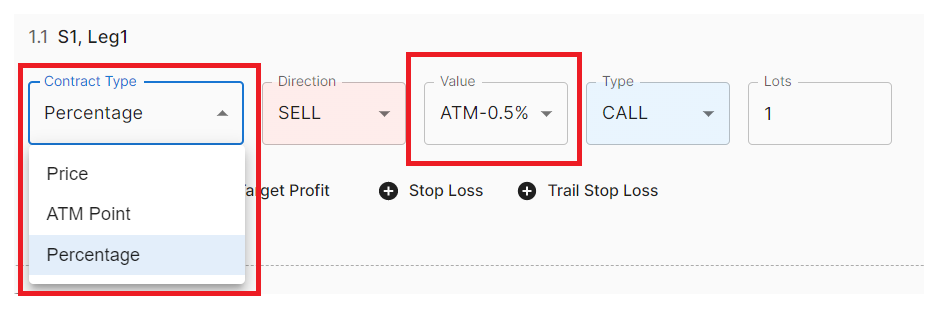

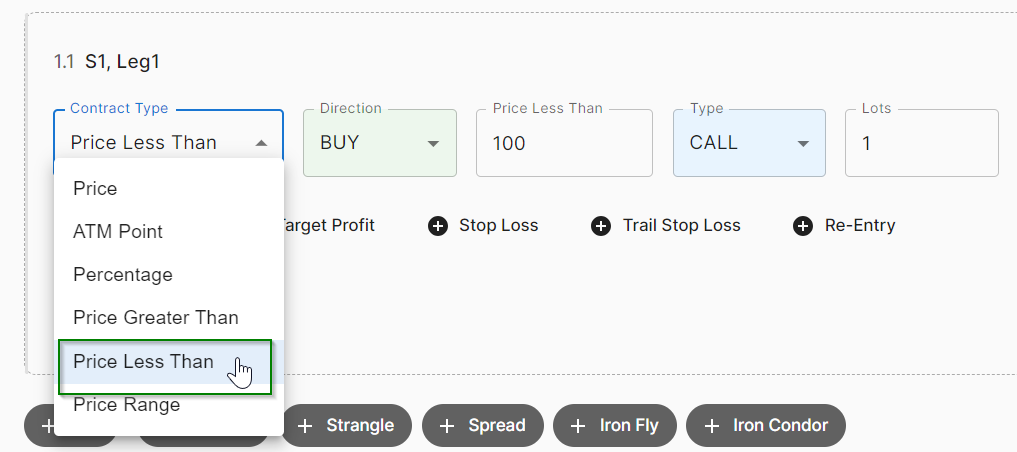

Contract Type

Options contract selection is an important consideration when building an options strategy. The selection of options contracts will depend on a different strategic factors of which SpeedBot's Options Strategy Builder currently Supports following criterion :

Price: Select Options Strikes based on the mentioned price by the Strategy Creator. For e.g: If the trader wants to Sell a CALL Options Contract having 100 INR Value then he/she can Contract Type as “Price” and enter the Closest Premium as “100 INR”.

ATM Point: Select Options Strikes based on the ATM, OTMs and ITMs of the available options contracts.

Percentage: Select Options Strikes based on adding and subtracting a certain percentage from the ATM. For E.g: If a Trader wants to select a CALL Options Contract that is 0.5% away from ATM then he/she can select the Contract Type as “Percentage” and Value as “ATM-0.5%”.

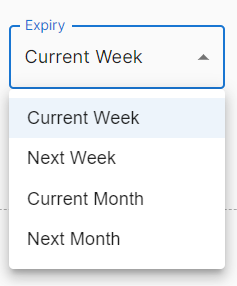

Expiry Type

Speedboat supports multiple expiry selection for assorted options trading strategies. Strategy creators can backtest on Current Week, Next Week, Current Month and Next Month Expiry Contracts.

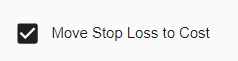

Move to Cost

In Options Trading move-to-cost is a popular concept that involves adjusting the strike price of an options position to bring the overall cost of the position down to a target level. This can be an effective way for traders to reduce the cost of an existing options position while still maintaining the same market exposure.

For SpeedBot Options strategy Builder, here is the feature explanation for "Move to Cost" :

If SL(StopLoss) of any of the legs is hit then SL(StopLoss) of all the open legs are moved to the Entry Price.

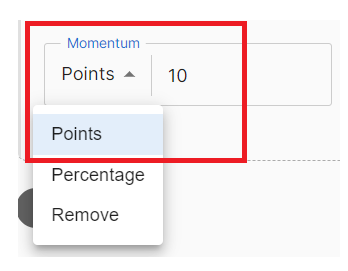

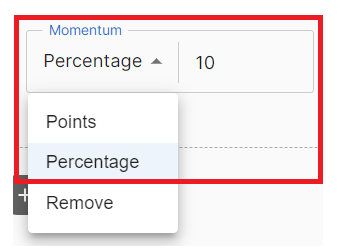

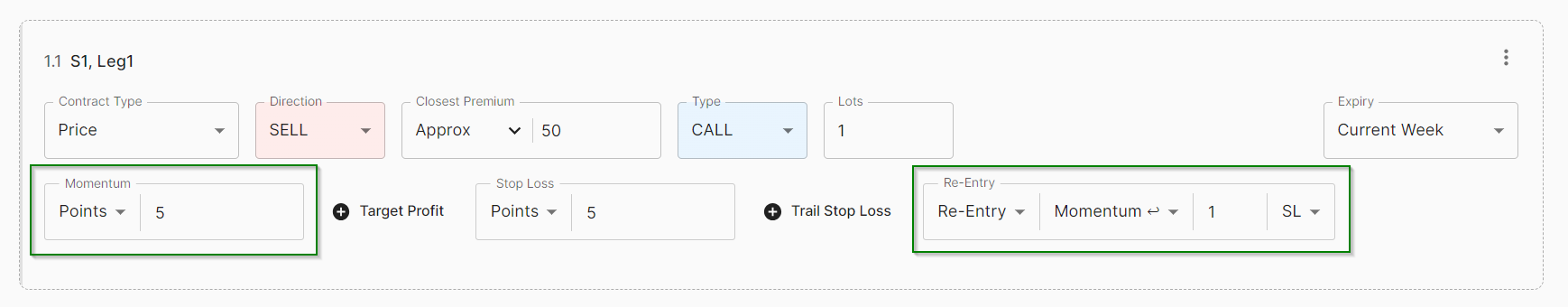

Momentum

Points: If the entry condition is satisfied then the bot will wait for the Options Contract to move by a certain amount of points. For E.g: If 18500 CALL Option is trading at 100 INR. premium and Momentum in Points is 10 then the bot will wait for the options contract to move to 110 points and then take an entry.

Percentage:If the entry condition is satisfied then the bot will wait for the Options Contract to move by a certain amount of percentage. For E.g: If 18500 CALL Option is trading at 100 INR. premium and Momentum in Percentage is 10 then the bot will wait for the options contract to move to 10 percent and then take an entry.

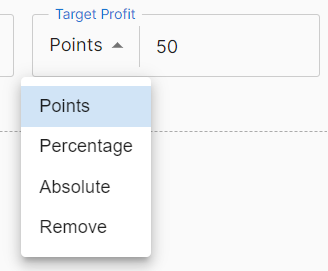

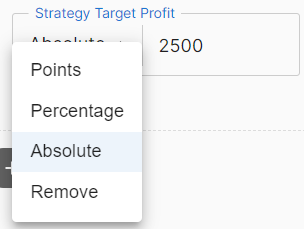

Target

The Target for individual leg can be set in terms of points, percentage and absolute (MTM) basis.

Points: If the options contract moves a certain defined points in the favour of the trader then.

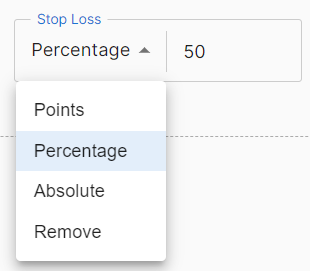

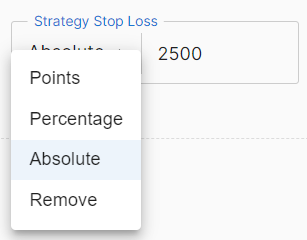

Stop-Loss

The Stop Loss for individual leg can be set in terms of points, percentage and absolute (MTM) basis.

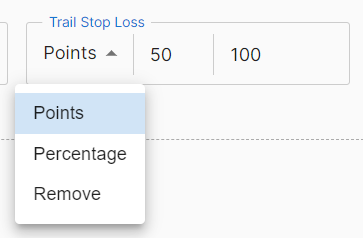

Trail SL (Stop Loss)

A trailing stop loss is a type of order that can be used in trading to automatically adjust the stop loss level as the price of an asset moves in favor of the trade. The trailing stop loss can help traders to protect their profits and limit their losses in a volatile market.

SpeedBot Options Builder avails to automate the Trailing Stop Loss for If the underlying price moves by a certain amount in terms of percentage or in absolute points then trail the SL by a certain percentage or in absolute points.

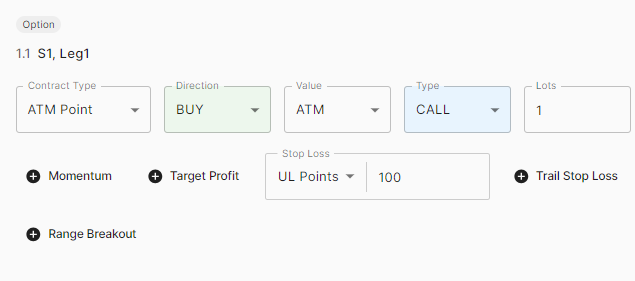

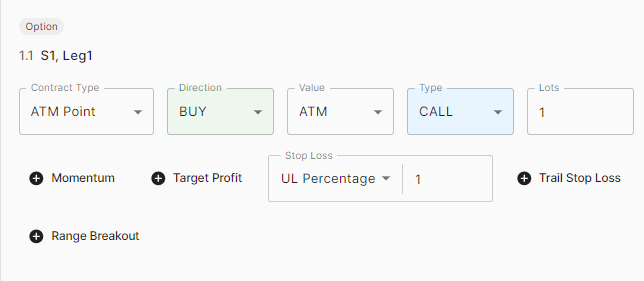

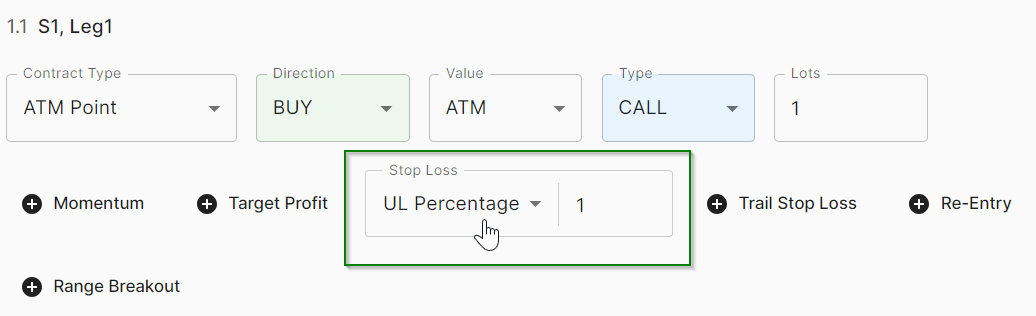

Leg Level SL Types - ULPoints and ULPercentage

Call LONG

-

UL Points

Example: If Entry UL Price is 50000, if it goes DOWN by 100 points i.e. when it crosses below 49900, SL will Hit. -

UL Percentage

Example: If Entry UL Price is 50000, if it goes DOWN by 1% i.e. when it crosses below 49500, SL will Hit.

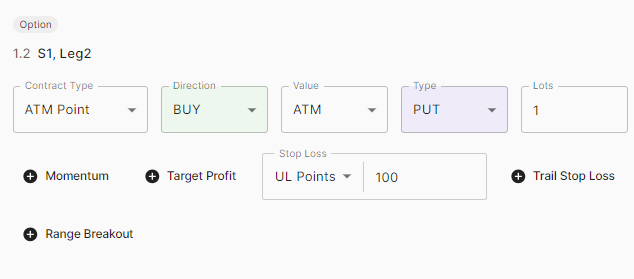

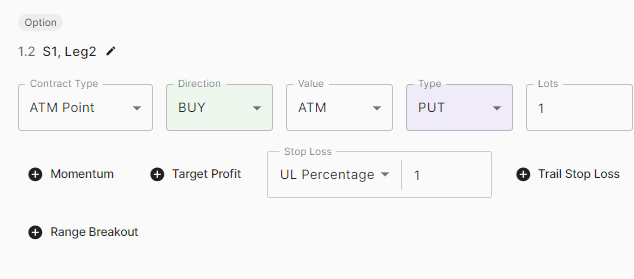

Put LONG

-

UL Points

Example: If Entry UL Price is 50000, if it goes UP by 100 points i.e. when it crosses above 50100, SL will Hit. -

UL Percentage

Example: If Entry UL Price is 50000, if it goes UP by 1% i.e. when it crosses above 50500, SL will Hit.

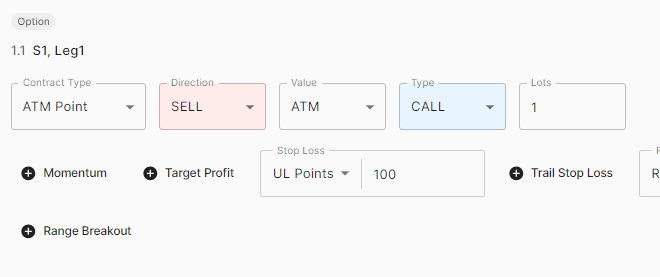

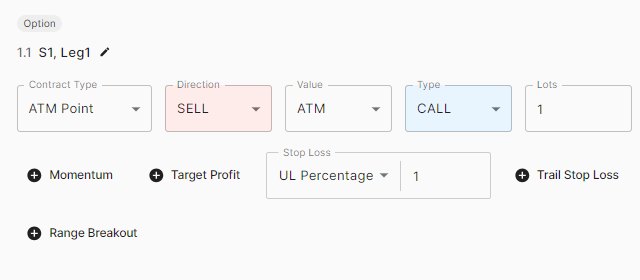

Call SHORT

-

UL Points

Example: If Entry UL Price is 50000, if it goes UP by 100 points i.e. when it crosses above 50100, SL will Hit. -

UL Percentage

Example: If Entry UL Price is 50000, if it goes UP by 1% i.e. when it crosses above 50500, SL will Hit.

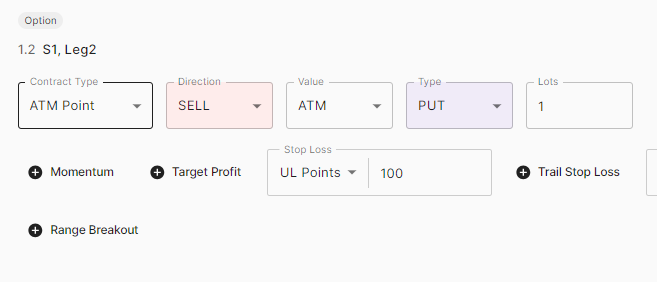

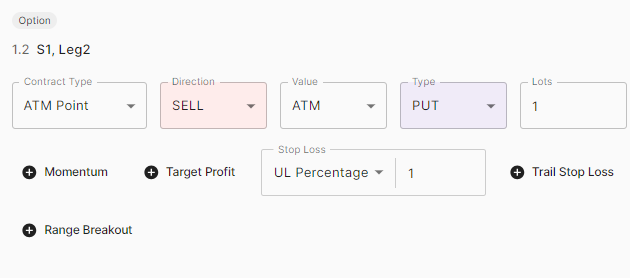

Put SHORT

-

UL Points

Example: If Entry UL Price is 50000, if it goes DOWN by 100 points i.e. when it crosses below 49900, SL will Hit. -

UL Percentage

Example: If Entry UL Price is 50000, if it goes DOWN by 1% i.e. when it crosses below 49500, SL will Hit.

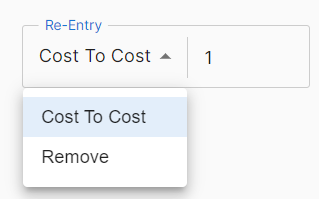

Reentry Type

Suppose if the ATM PE is sold at an entry price of Rs.50 and SL is 100% i.e. Rs.100. If the SL is hit then the bot will wait and re-enter again whenever the price will come at Rs.50.

Strategy Target

Strategy Creators can create options strategies with predefined targets on all the available options contracts used.

Strategy Stop Loss

Strategy level Stop Loss feature allows risk management of Options Trading strategies. It helps to minimize the potential losses while maximizing their potential profits for particular Options Trading Algo Strategy. Strategy Creators can create options strategies with predefined stop losses on all the available options contracts used.

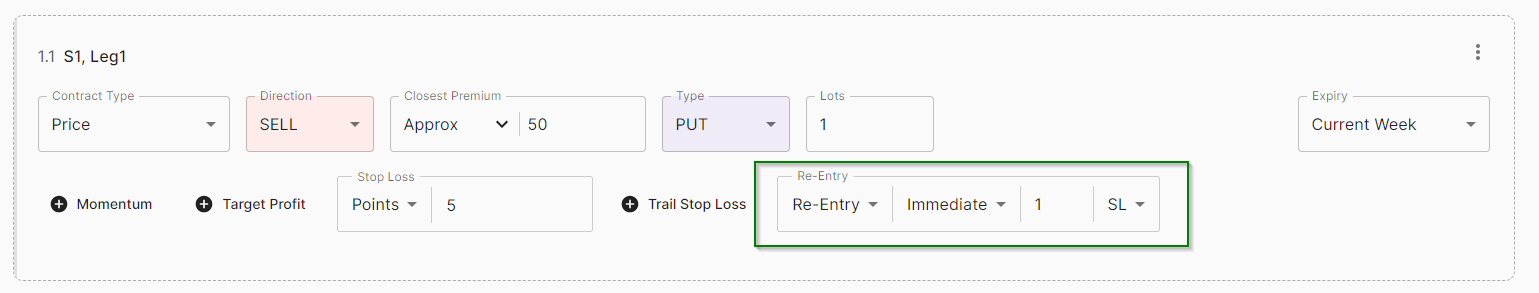

Re-Entry/Re-Execution

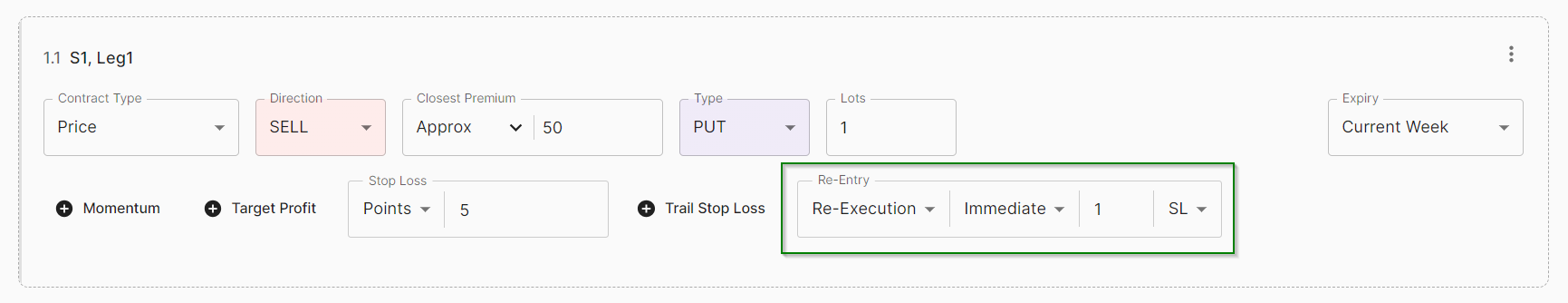

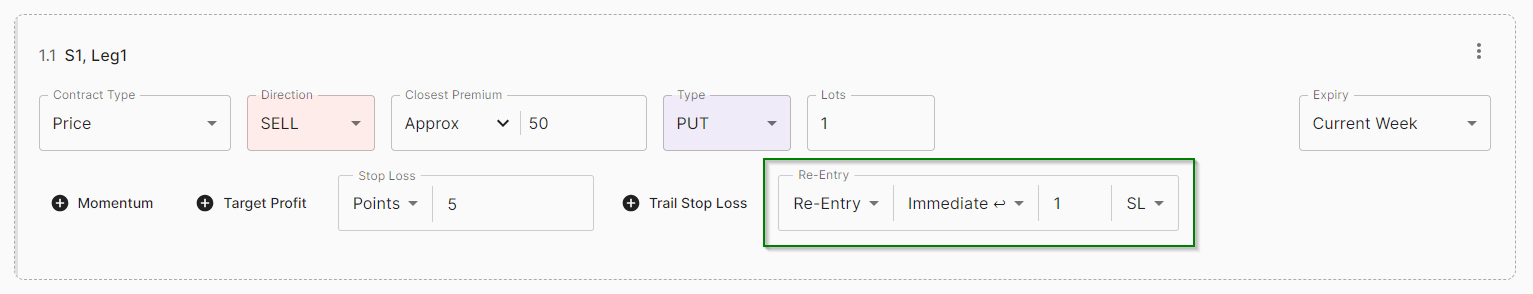

1) What is the difference between Re-Entry and Re-Execution in SpeedBot Options Bot Builder?

Re-Entry Once, the Stop Loss or Target of an options contract is hit then the bot will take a fresh entry again in the same contract.

Re-Execution Once, the Stop Loss or Target of an options contract is hit then the bot will take a fresh entry again in the new contract.

Types of Re-Entry

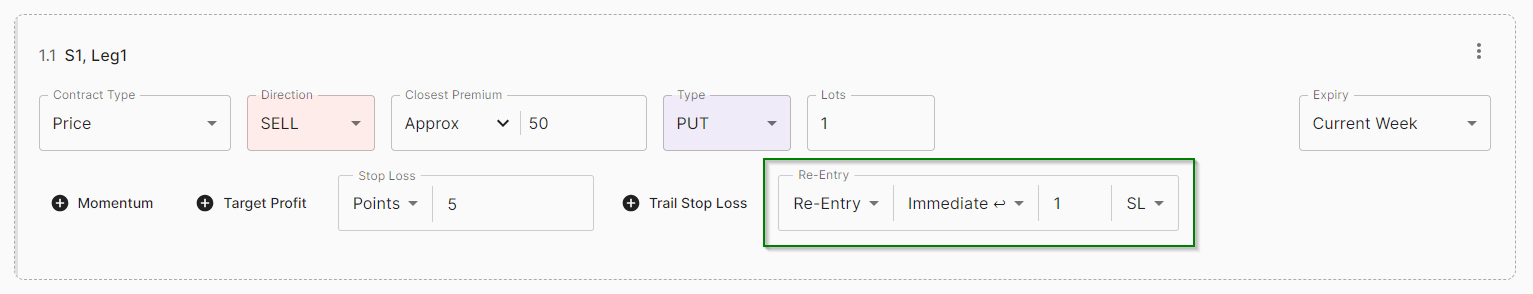

Re-Entry Immediate: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and the stop loss gets hit then Options Bot will enter immediately in the same contract and same direction, if Re-Entry Immediate option is selected based on Stop Loss. i.e. Short 19750PE.

Re-Entry Immediate ↩: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and the stop loss gets hit then Options Bot will enter immediately in the same contract and opposite direction, if Re-Entry Immediate ↩ option is selected based on Stop Loss. i.e. Long 19750PE.

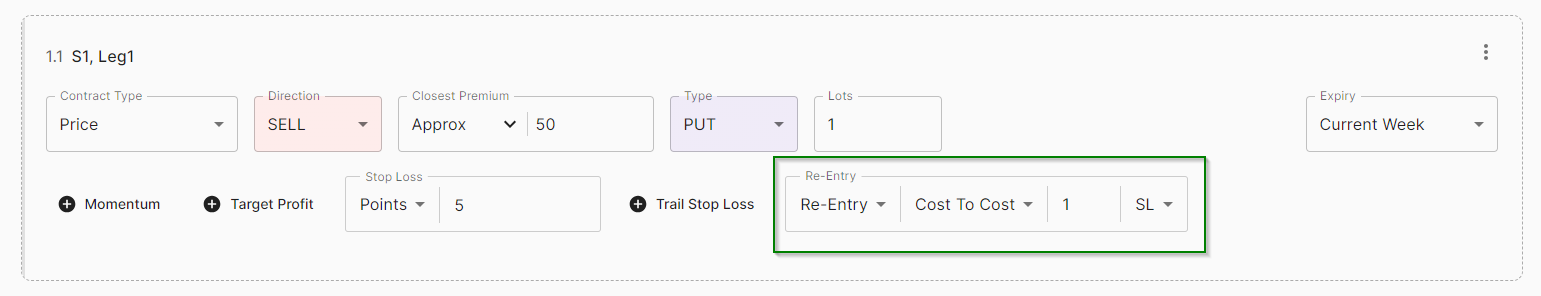

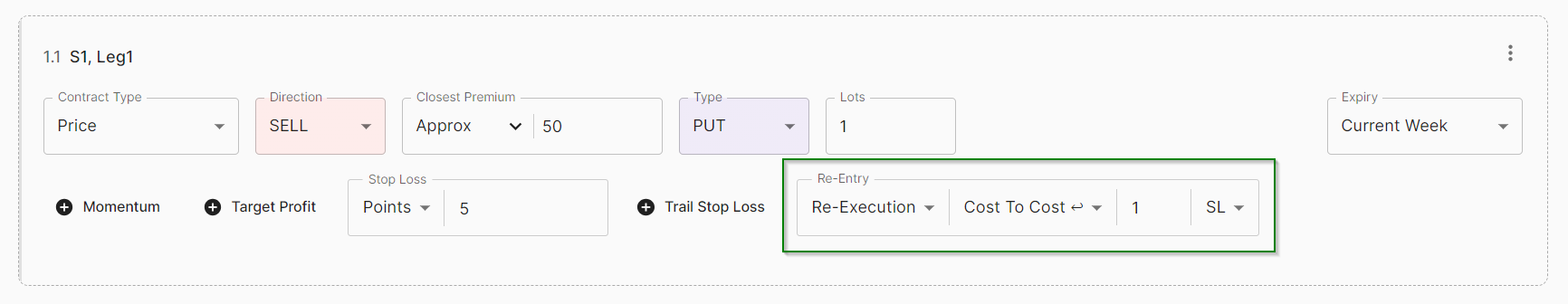

Re-Entry Cost to Cost: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and the stop loss gets hit then Options Bot will enter when the same contract has reached to its Entry Price in the same direction, if Re-Entry Cost to Cost option is selected based on Stop Loss. i.e. Short 19750PE at INR. 50 as the closest premium.

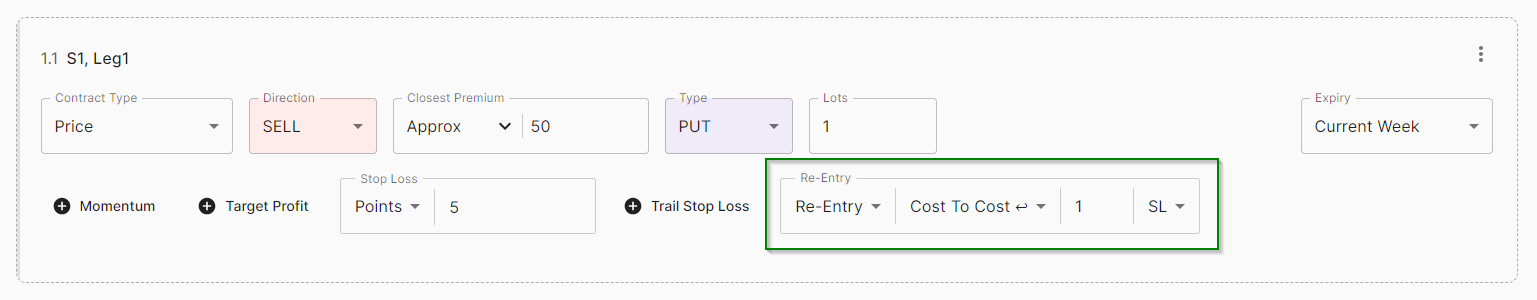

Re-Entry Cost to Cost ↩: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and the stop loss gets hit then Options Bot will enter when the same contract has reached to its Entry Price in the opposite direction, if Re-Entry Cost to Cost option is selected based on Stop Loss. i.e. Long 19750PE at INR. 50 as the closest premium.

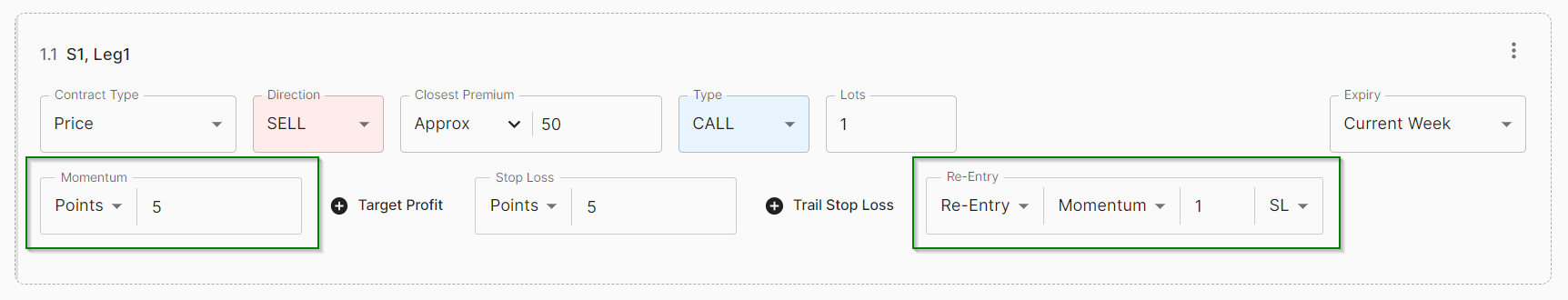

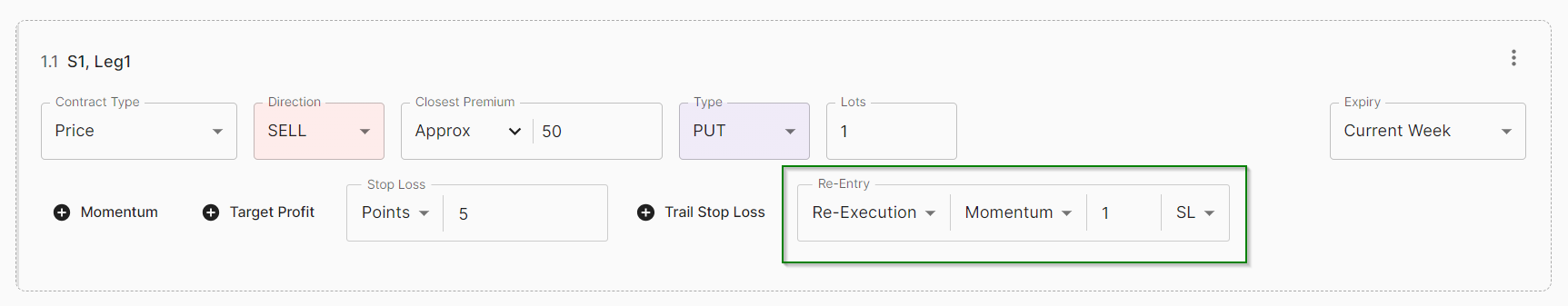

Re-Entry Momentum: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and a Momentum of 5 points (i.e. If the Direction is Sell then the Bot will wait for the contract to move from 50 to 45) and when the stop loss gets hit then Options Bot will enter in the same contract wait for the contract to move from Current Market Price to 5 points in the same direction, if Re-Entry Momentum option is selected along with Momentum based on Stop Loss.

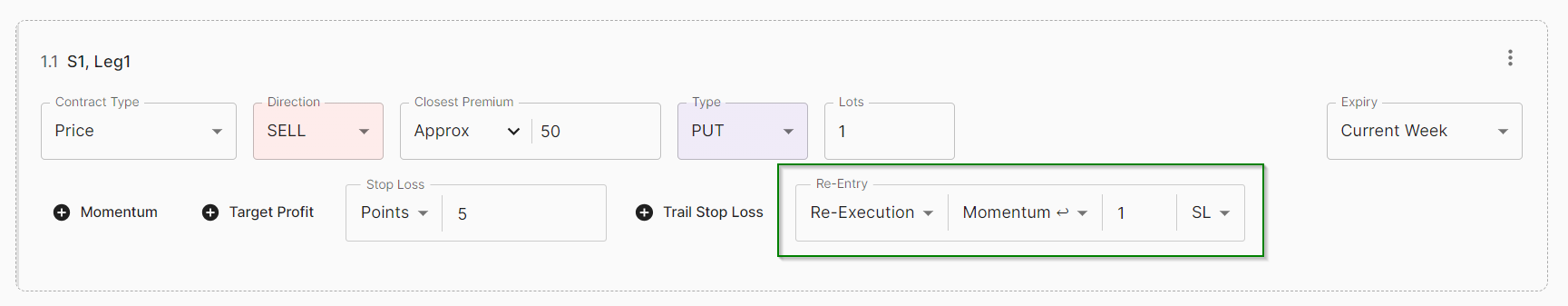

Re-Entry Momentum ↩: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and a Momentum of 5 points (i.e. If the Direction is Sell then the Bot will wait for the contract to move from 50 to 45) and when the stop loss gets hit then Options Bot will enter in the same contract wait for the contract to move from Current Market Price to 5 points in the opposite direction, if Re-Entry Momentum ↩ option is selected along with Momentum based on Stop Loss.

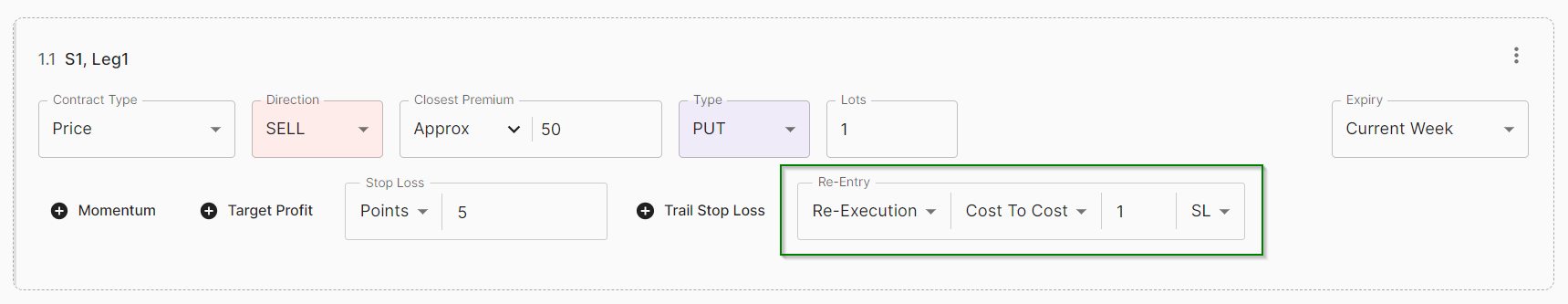

Types of Re-Execution

Re-Execution Immediate: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and the stop loss gets hit then Options Bot will enter immediately in the different contract and same direction, if Re-Execution Immediate option is selected based on Stop Loss. i.e. Short 19800PE.

Re-Execution Immediate ↩: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and the stop loss gets hit then Options Bot will enter immediately in the different contract and opposite direction, if Re-Execution Immediate ↩ option is selected based on Stop Loss. i.e. Long 19800PE.

Re-Execution Cost to Cost: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and the stop loss gets hit then Options Bot will enter when the same contract has reached to its Entry Price in the different direction, if Re-Execution Cost to Cost option is selected based on Stop Loss. i.e. Short 19800PE at INR. 50 as the closest premium.

Re-Execution Cost to Cost ↩: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and the stop loss gets hit then Options Bot will enter when the different contract has reached to its Entry Price in the opposite direction, if Re-Execution Cost to Cost option is selected based on Stop Loss. i.e. Long 19800PE at INR. 50 as the closest premium.

Re-Execution Momentum: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and a Momentum of 5 points (i.e. If the Direction is Sell then the Bot will wait for the contract to move from 50 to 45) and when the stop loss gets hit then Options Bot will enter in the different contract wait for the contract to move from Current Market Price to 5 points in the same direction, if Re-Execution Momentum option is selected along with Momentum based on Stop Loss.

Re-Execution Momentum ↩: Suppose, you enter a Short NIFTY PE contract with INR. 50 as closest premium (i.e. 19750PE) at 9.20 AM with a 5 points stop loss and a Momentum of 5 points (i.e. If the Direction is Sell then the Bot will wait for the contract to move from 50 to 45) and when the stop loss gets hit then Options Bot will enter in the different contract wait for the contract to move from Current Market Price to 5 points in the opposite direction, if Re-Execution Momentum ↩ option is selected along with Momentum based on Stop Loss.

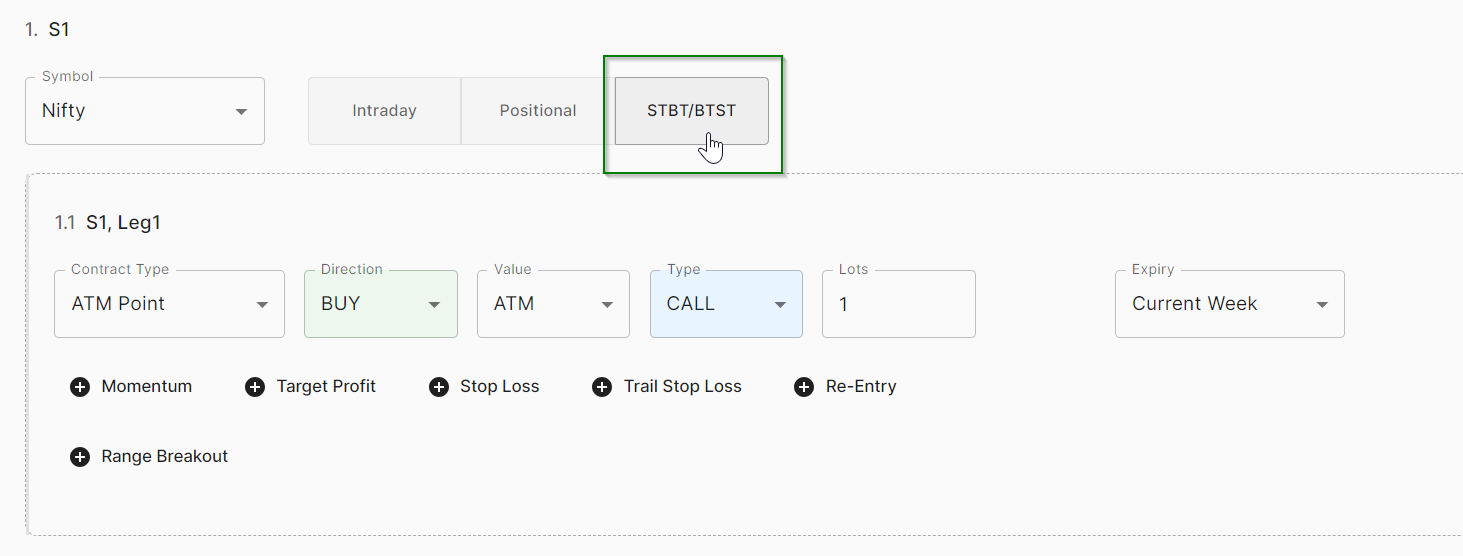

STBT/BTST

Suppose, if you bought ATM Call option contract and select the option “STBT/BTST” i.e. Buy today and Sell tomorrow (Long) or Sell today and Buy tomorrow (Short) then entry mentioned by the trader will be taken today and the exit will happen on the very next trading day on the exit time mentioned.

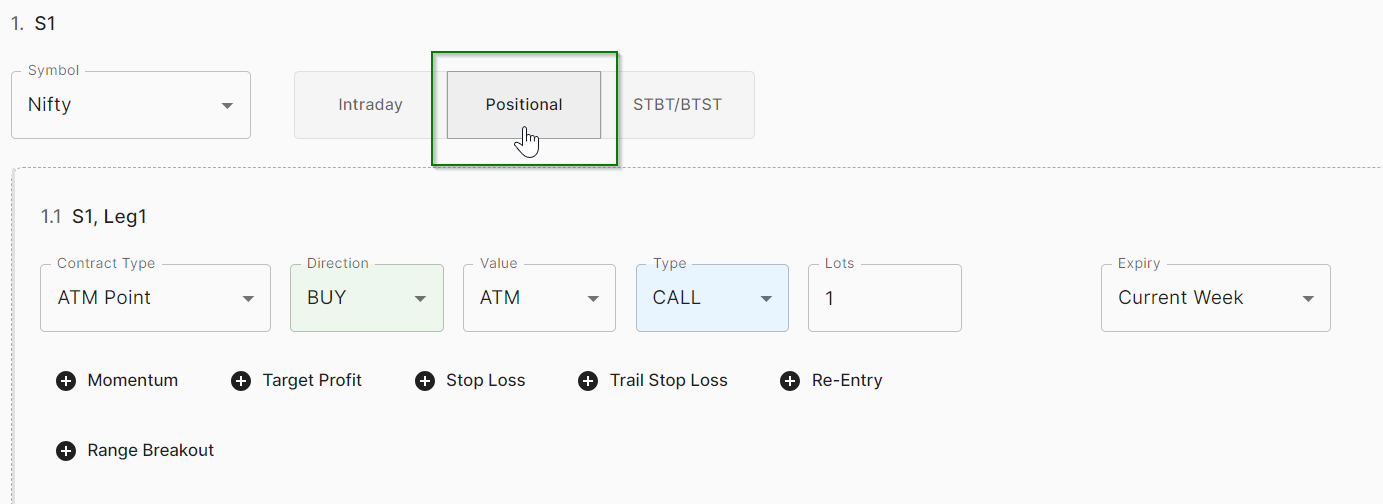

Positional:

Suppose, if you want to trade positionally (take trades for more than 1 day) in options then you can select “Positional” as mentioned in the figure.

As you can see we have bought an ATM Call Option contract, positionally. In the second image you can see that the Expiry selected is “Weekly” which means that the maximum holding period this ATM Call option can ideally be 4 days from the expiry day.

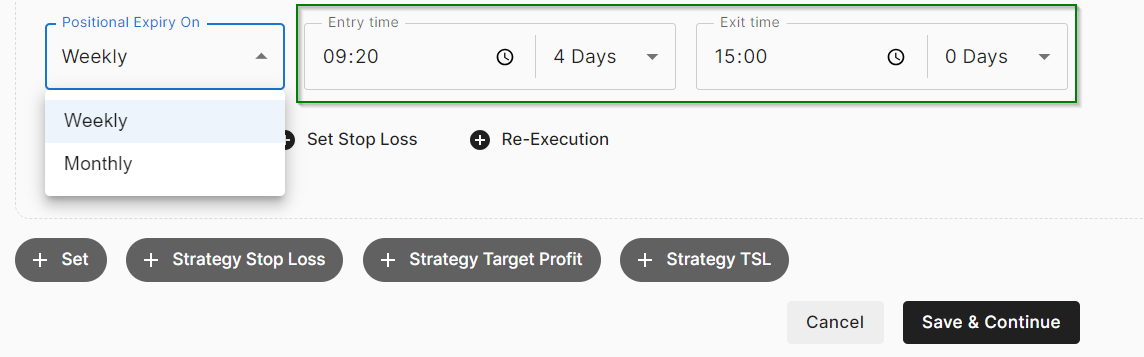

Contract type

Price Greater than

Suppose, if you want to select Call option contracts that have price greater than 100 then you can use this selection.

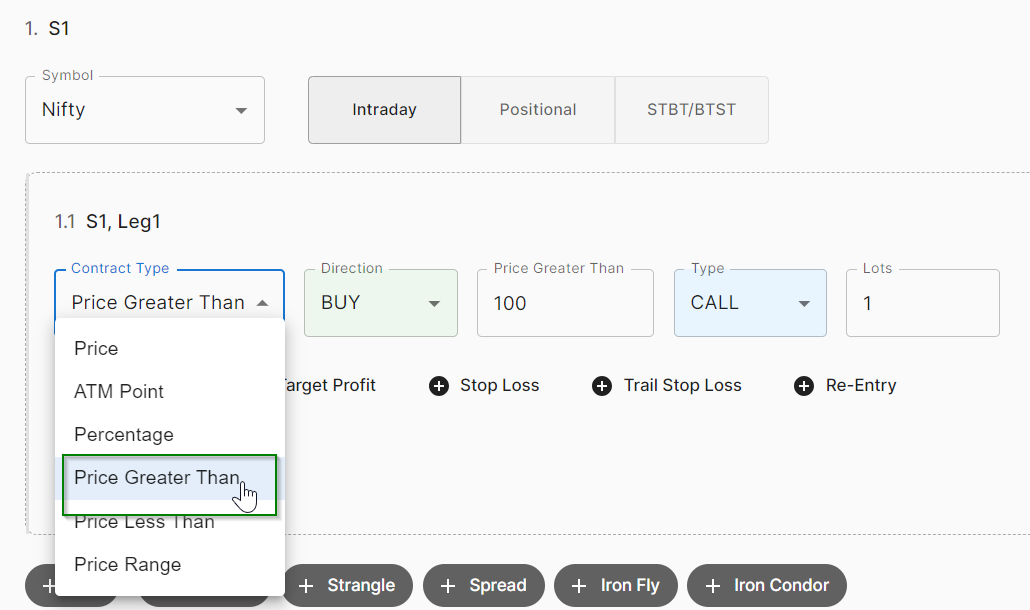

Price Less than

Suppose, if you want to select Call option contracts that have price less than 100 then you can use this selection.

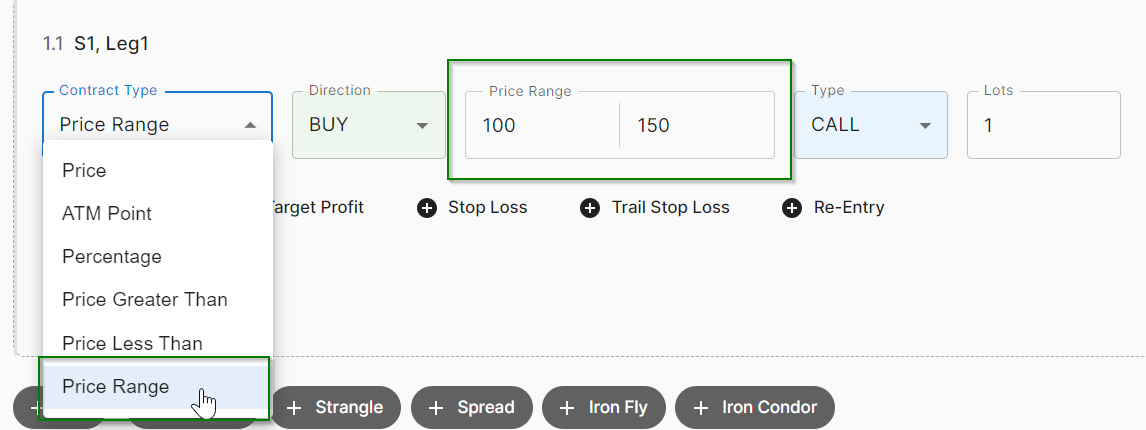

Price Range

Suppose, if you want to select Call option contracts that have price greater than 100 and lesser than 150 then you can use this selection.

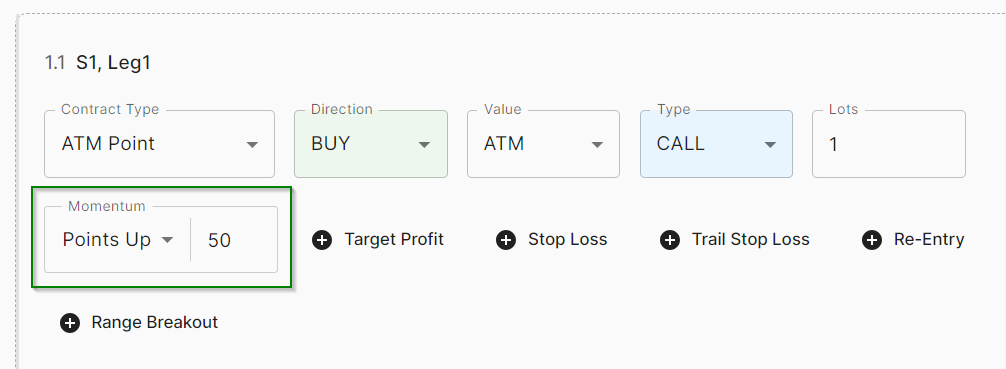

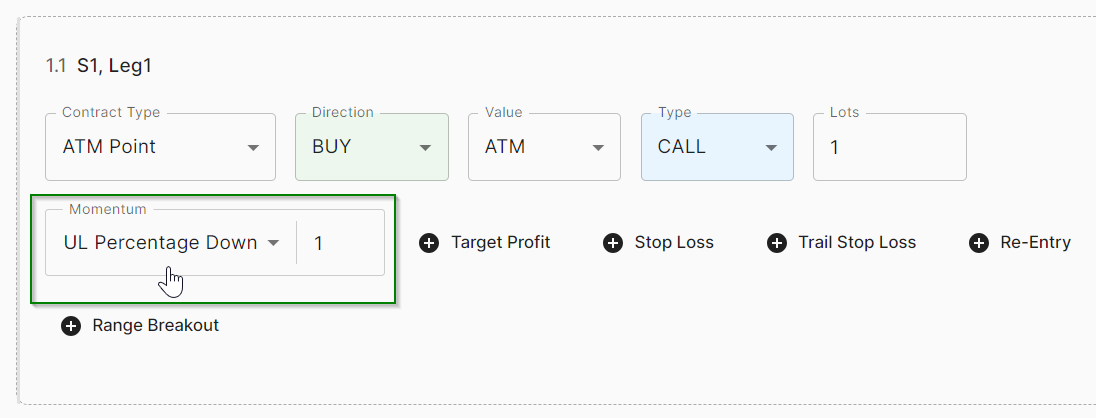

Momentum

Points Up

Suppose if you want to buy an ATM Call option contract only when there is a movement of 50 points upwards from the mentioned entry time then the bot will execute the trade.

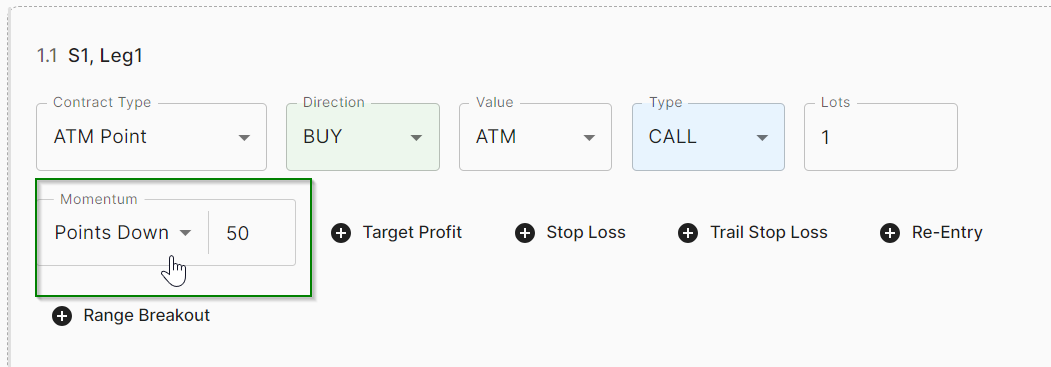

Points Down

Suppose if you want to buy an ATM Call option contract only when there is a movement of 50 points downwards from the mentioned entry time then the bot will execute the trade.

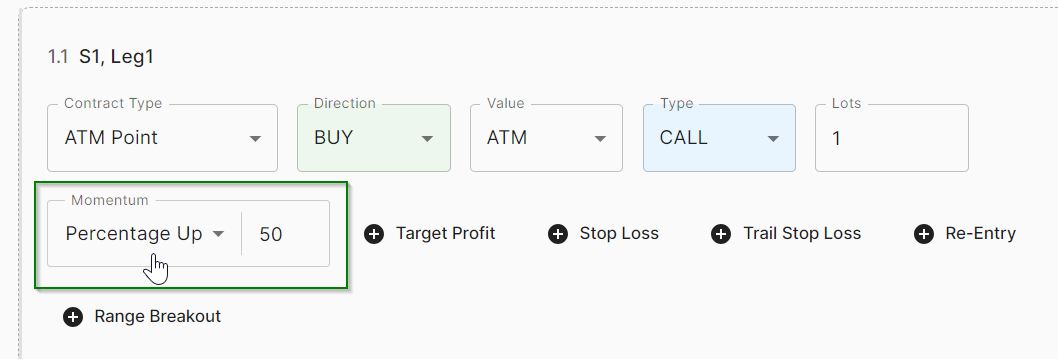

Percentage Up

Suppose if you want to buy an ATM Call option contract only when there is a movement of 50 percent upwards from the mentioned entry time then the bot will execute the trade.

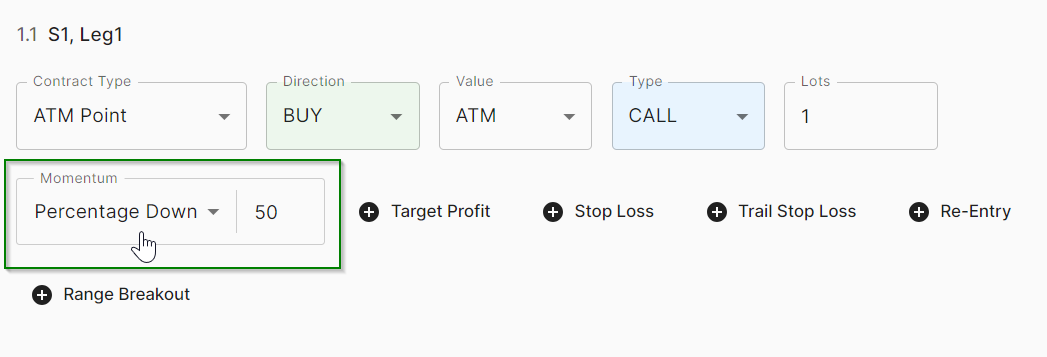

Percentage Down

Suppose if you want to buy an ATM Call option contract only when there is a movement of 50 percent downwards from the mentioned entry time then the bot will execute the trade.

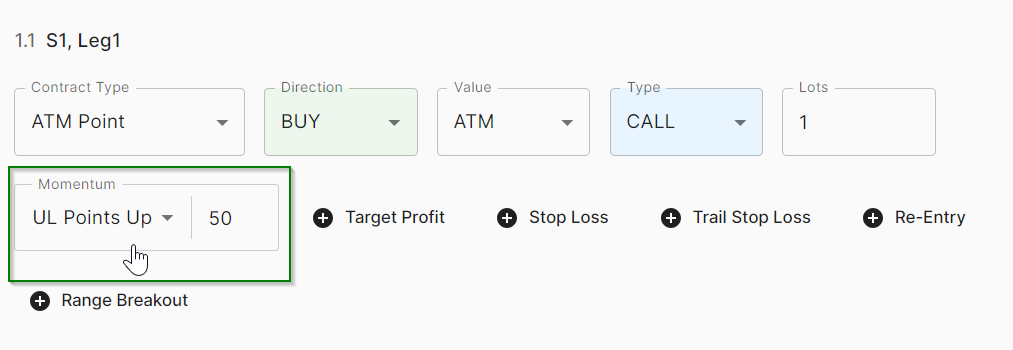

UL Points Up

Suppose if you want to buy an ATM Call option contract only when there is a movement of 50 points upwards in the underlying index (i.e. NIFTY or BANKNIFTY) from the mentioned entry time then the bot will execute the trade.

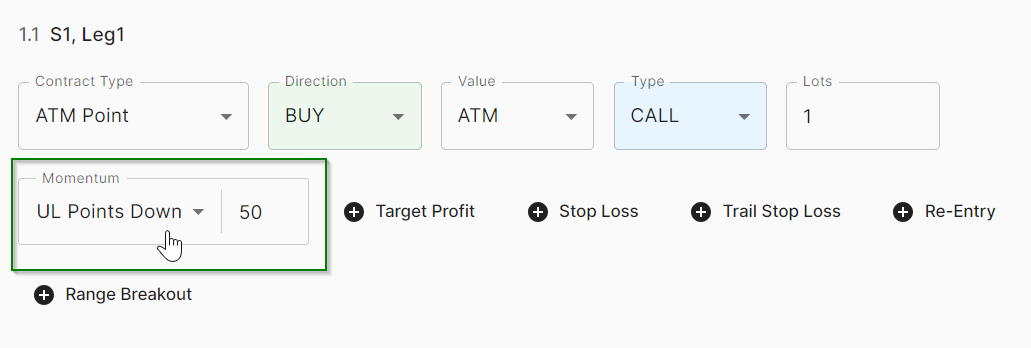

UL Points Down

Suppose if you want to buy an ATM Call option contract only when there is a movement of 50 points downwards in the underlying index (i.e. NIFTY or BANKNIFTY) from the mentioned entry time then the bot will execute the trade.

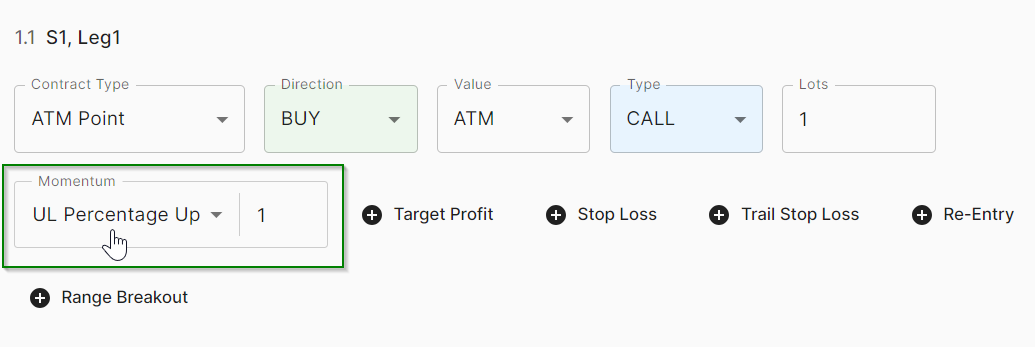

UL Percentage Up

Suppose if you want to buy an ATM Call option contract only when there is a movement of 1 percent upwards in the underlying index (i.e. NIFTY or BANKNIFTY) from the mentioned entry time then the bot will execute the trade.

UL Percentage Down

Suppose if you want to buy an ATM Call option contract only when there is a movement of 1 percent downwards in the underlying index (i.e. NIFTY or BANKNIFTY) from the mentioned entry time then the bot will execute the trade.

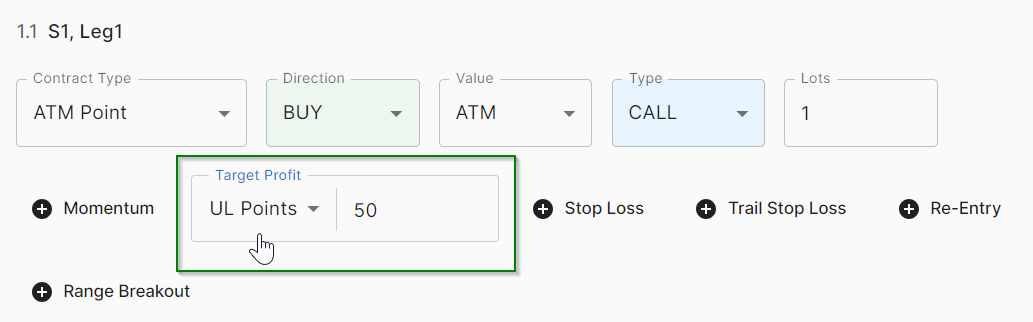

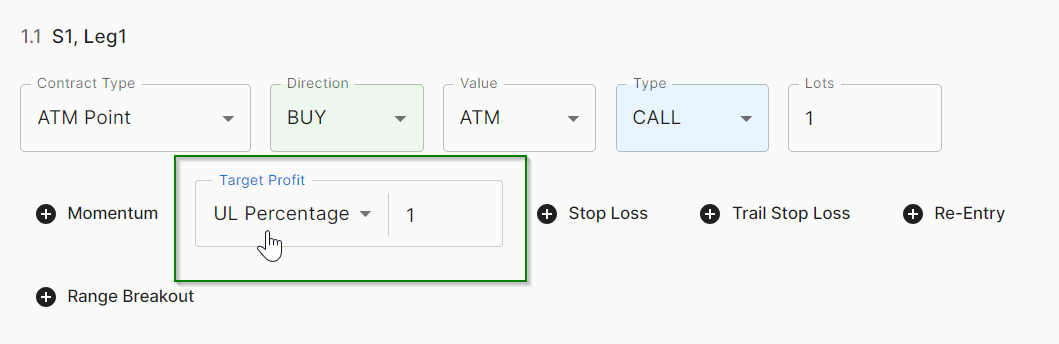

Target

UL Points

Suppose if you have bought an ATM Call option contract and you want to exit the trade i.e. target when there is a movement of 50 points in the underlying index (i.e. NIFTY or BANKNIFTY).

UL Percentage

Suppose if you have bought an ATM Call option contract and you want to exit the trade i.e. target when there is a movement of 1 percent in the underlying index (i.e. NIFTY or BANKNIFTY).

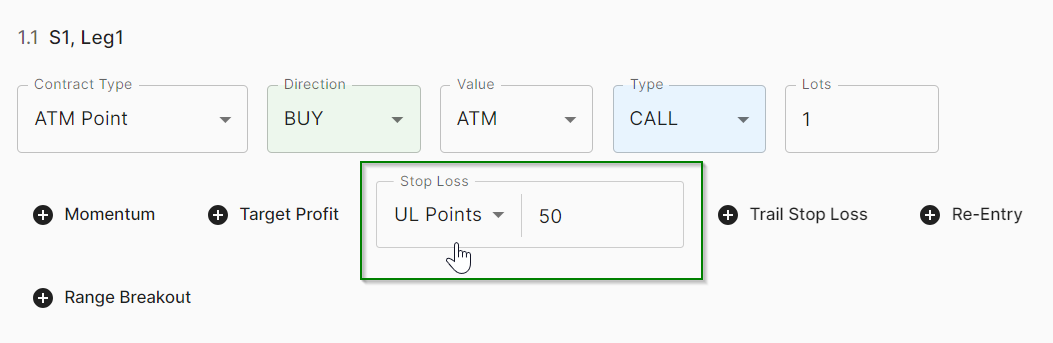

Stop Loss

UL Points

Suppose if you have bought an ATM Call option contract and you want to exit the trade i.e. stop loss when there is a movement of 50 points in the underlying index (i.e. NIFTY or BANKNIFTY).

UL Percentage

Suppose if you have bought an ATM Call option contract and you want to exit the trade i.e. stop loss when there is a movement of 1 percent in the underlying index (i.e. NIFTY or BANKNIFTY).

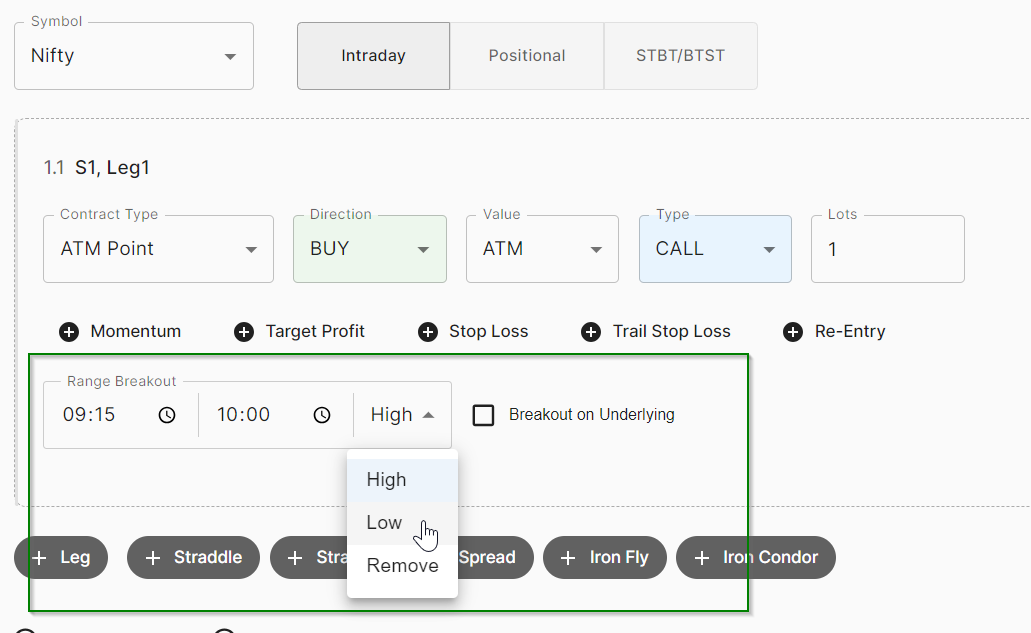

Range Breakout

UL Points

Range Breakout means to take entry whenever the latest price or current market price has breached the “High” or “Low” of the time interval mentioned.

Note that Range breakout conditions can be checked on Options Contract as well as on Underlying index.

In the above mentioned figure, we have selected to buy ATM Call option only when the “High” of the time interval between 09:15 to 10:00 is broken on the ATM Call Option selected.

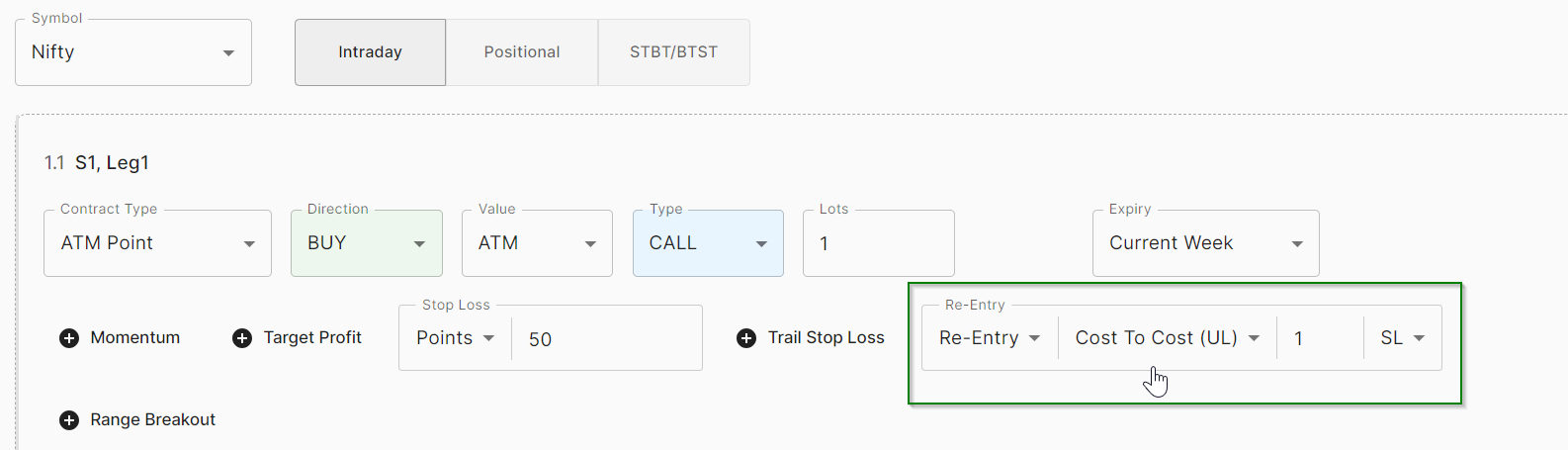

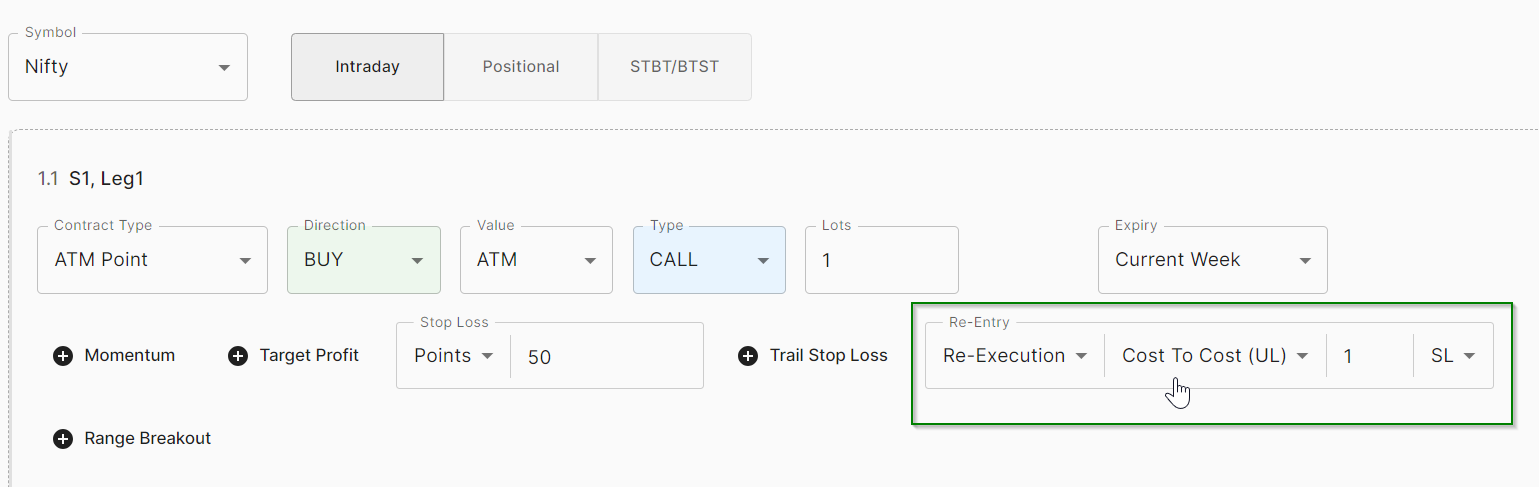

Re-Entry

Cost To Cost (UL)

Suppose the ATM Call option is bought with a stop loss of 50 points and Re-entry based on Cost to Cost on the Underlying Index. I.e the Underlying price of Nifty was 21735 at Entry time 9.20 AM the contract bought was 21750 CE with a stop loss of 50 points. Now if stop loss is hit then the re-entry in the same contract will happen when the current market price reaches 21735.

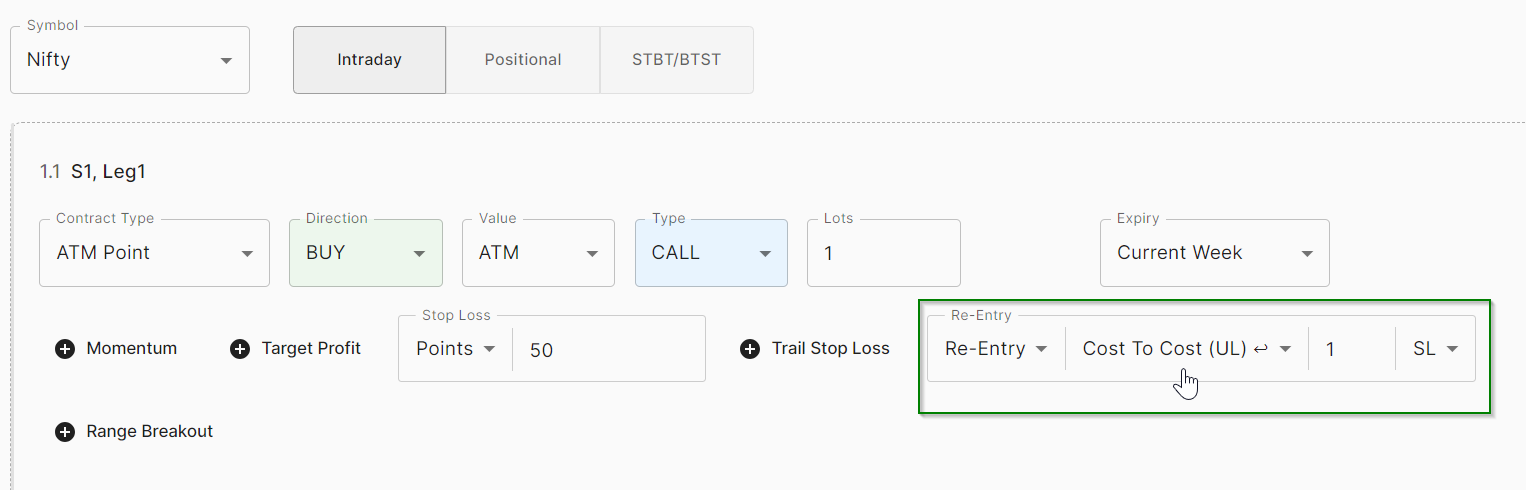

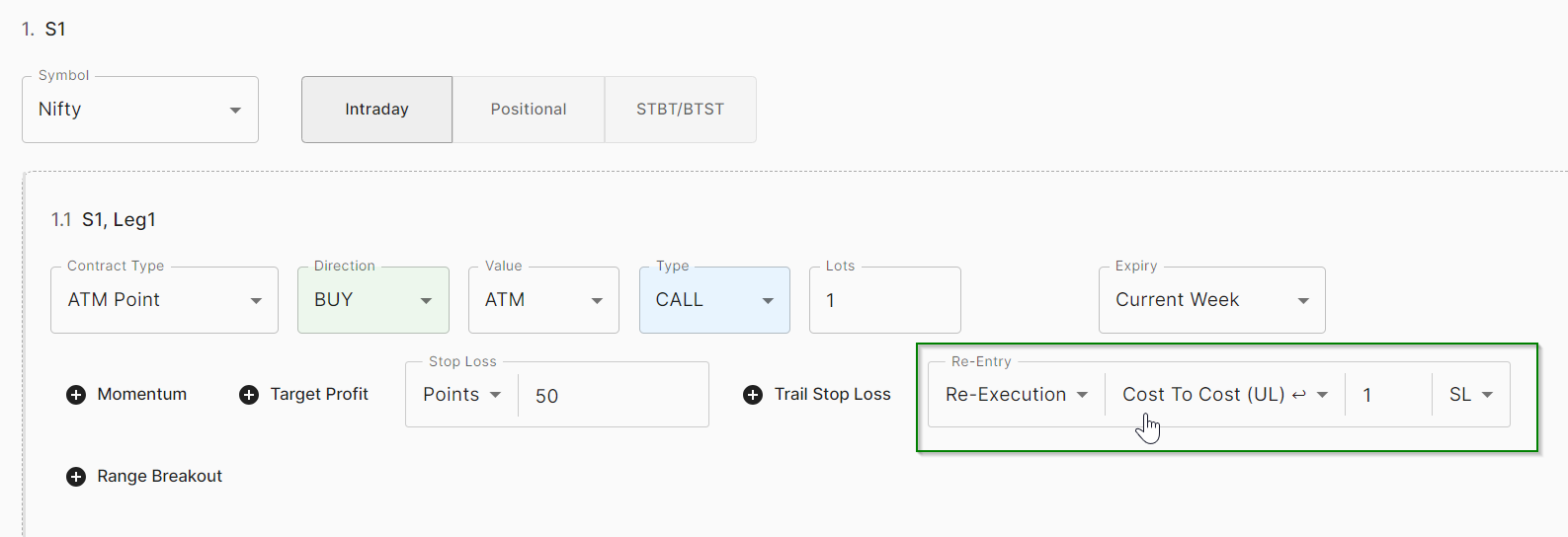

Cost To Cost (UL) ↩

Suppose the ATM Call option is bought with a stop loss of 50 points and Re-entry based on Cost to Cost on the Underlying Index. I.e the Underlying price of Nifty was 21735 at Entry time 9.20 AM the contract bought was 21750 CE with a stop loss of 50 points. Now if stop loss is hit then the re-entry in the same contract with opposite direction i.e. Sell will happen when the current market price reaches 21735.

Re-Execution

Cost To Cost (UL)

Suppose the ATM Call option is bought with a stop loss of 50 points and Re-execution based on Cost to Cost on the Underlying Index. I.e the Underlying price of Nifty was 21735 at Entry time 9.20 AM the contract bought was 21750 CE with a stop loss of 50 points. Now if stop loss is hit then the re-execution in the contract based on the current ATM will happen when the current market price reaches 21735.

Cost To Cost (UL) ↩

Suppose the ATM Call option is bought with a stop loss of 50 points and Re-execution based on Cost to Cost on the Underlying Index. I.e the Underlying price of Nifty was 21735 at Entry time 9.20 AM the contract bought was 21750 CE with a stop loss of 50 points. Now if stop loss is hit then the re-execution in the contract based on the current ATM with opposite direction i.e. Sell will happen when the current market price reaches 21735.